capital gains tax proposal effective date

This period saw the creation of Corporation Tax which combined the Capital Gains Income and Corporation Profits Tax that firms previously had to pay. Long-term capital gains and qualified dividends of taxpayers with an adjusted gross income of more than 1 million would be taxed at ordinary income tax rates with 37 generally being the highest rate 408 including the net investment income tax but only to the extent that the taxpayers income exceeds 1 million 500000 for married filing separately indexed for.

Income Statement Template 40 Templates To Track Your Company Revenues And Expenses Template S Income Statement Statement Template Profit And Loss Statement

However how tax is payable on these gains for current fiscal ie.

. Another view is that the 30 tax proposed in Budget 2022 on. We estimate the new House bill would reduce long-run GDP by about 05 percent and long-run American incomes as measured by gross national product or. Individuals paid capital gains tax at their highest marginal rate of income tax 0 10 20 or 40 in the tax year 20078 but from 6 April 1998 were able to claim a taper relief which reduced the amount of a gain that is subject to capital gains tax thus reducing the effective rate of tax depending on whether the asset is a business asset or a non-business asset and the length.

One widely held view is that capital gains tax can be paid on these gains in this fiscal following the income tax laws that apply to capital gains. The effective tax rate is the rate of taxation implied by the actual quantum of tax paid versus profits before all deductions are applied. This can be a particularly good strategy for those in the 10 and 12 tax brackets since their capital gains tax may be zero.

While the latest proposal steers clear of some of the major tax rate increases of the original Ways and Means bill this proposal would still raise taxes on work and investment disincentivizing productive activity. FY2021-22 is still a grey area with experts holding different views. Future changes to the corporate tax system such as the measures implemented by various.

Best Accounting Consultancy Service Provider Usa Hcllp Accounting Consultant Accounting Services Accounting

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

Not All Marketing Automation Platforms Are Born Equal Don T Choose The Wrong One Marketing Automation Inbound Marketing Marketing Technology

43 4 Capital Gain Tax 10 Things To Know

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

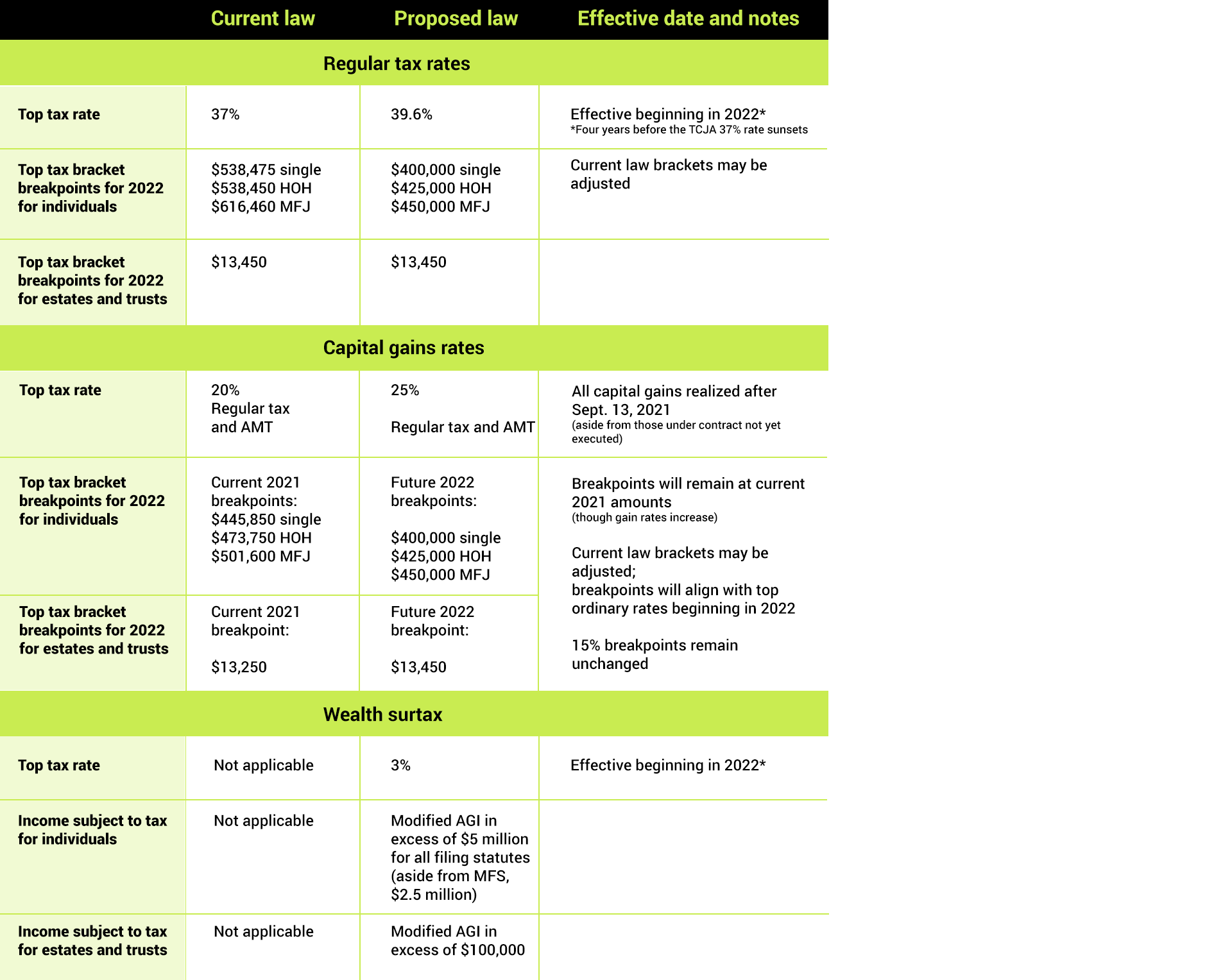

Tax Proposals Under The Build Back Better Act Version 2 0

House Introduces Major Tax Proposals Baker Tilly

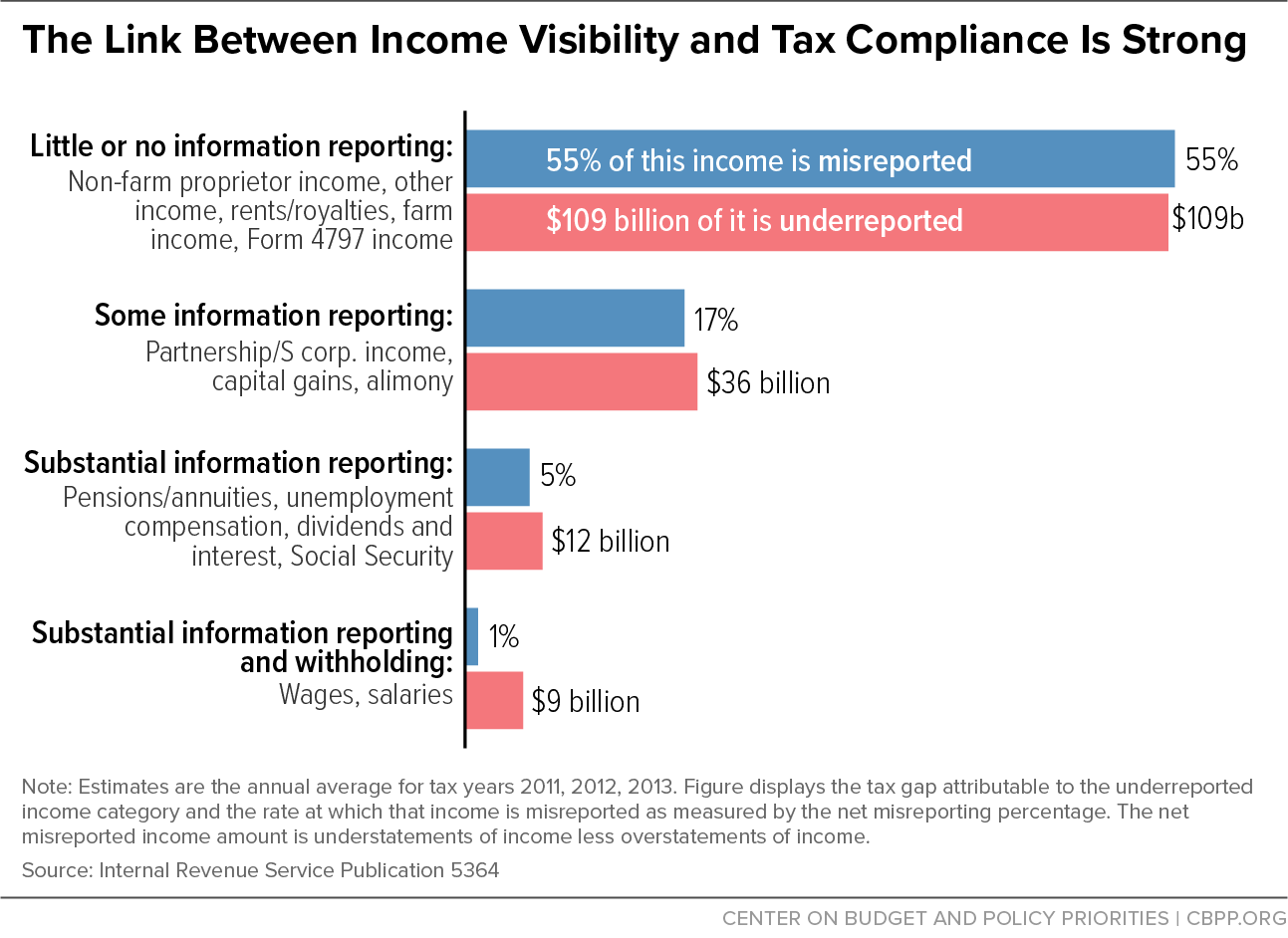

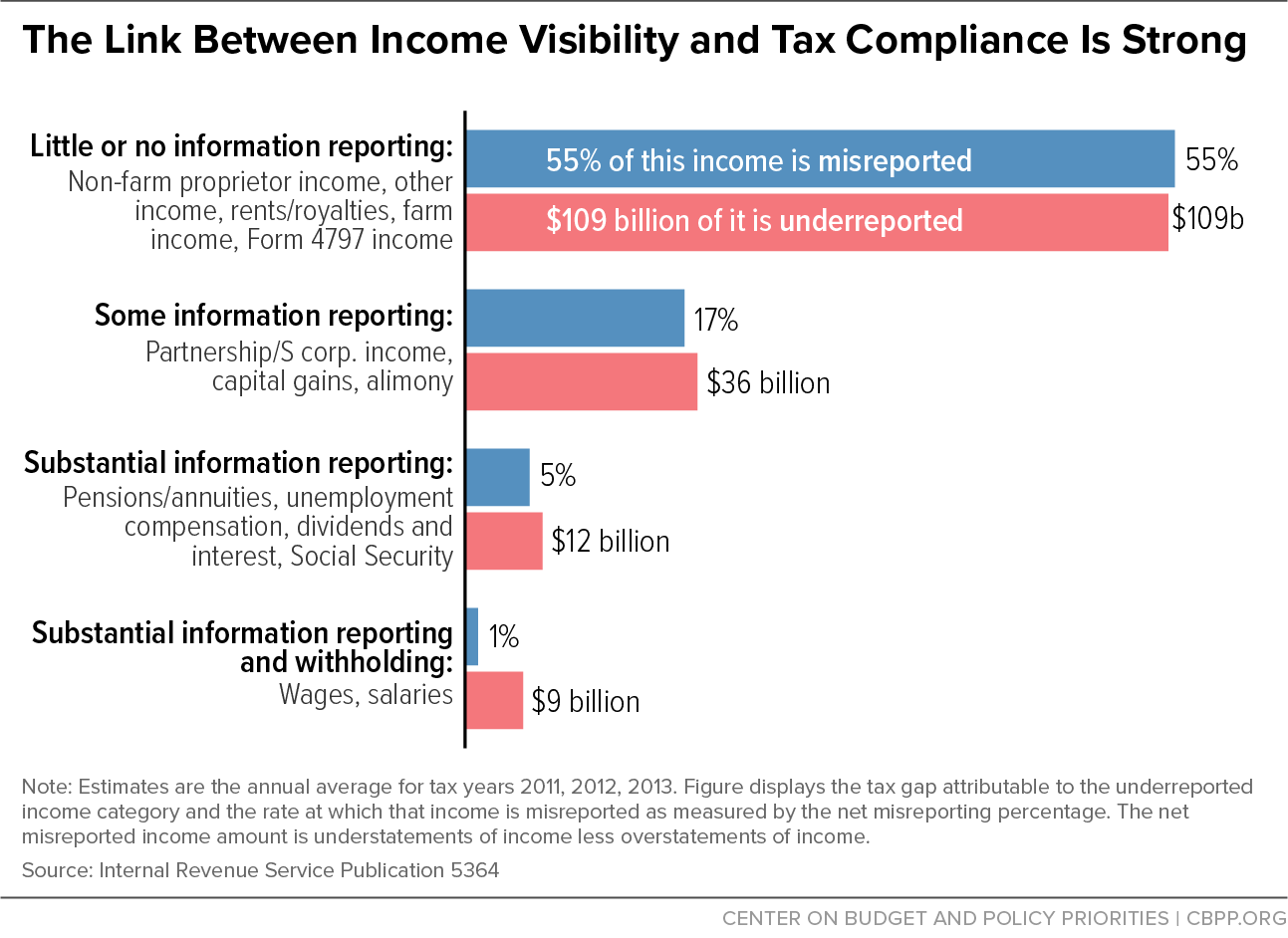

Build Back Better Requires Highest Income People And Corporations To Pay Fairer Amount Of Tax Reduces Tax Gap Center On Budget And Policy Priorities

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Democrats Eye Tax Opportunities In 2021 Grant Thornton

Historical Capital Gains And Taxes Tax Policy Center

Build Back Better Requires Highest Income People And Corporations To Pay Fairer Amount Of Tax Reduces Tax Gap Center On Budget And Policy Priorities

How Might The Taxation Of Capital Gains Be Improved Tax Policy Center

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Top View Of Rules Text Made From Scrabble Game Letters Paid Affiliate Sponsored Rules Text Letters V Scrabble Black Backdrops Light Wooden Floor